Have you been wanting to get your finances in order but feel overwhelmed just thinking about it? Maybe you and your partner have been meaning to sync up on budgeting, but life keeps getting in the way. The good news? Taking control of your financial wellness doesn’t have to be stressful or frustrating—it can actually be empowering and even (dare we say) fun when you have the right tools!

In our own circle of friends, financial planning has been a hot topic lately. With rising costs, unexpected expenses, and big life goals on the horizon, keeping track of spending is more important than ever. That’s why I felt called to share the Financial Health Google Sheets template that my husband and I have been using for months now—and it has been a total game-changer.

Why We Love This Budgeting Template

Since we started using this Financial Health Google Sheet, our approach to money has become clearer, more intentional, and way less stressful. Here’s why it works for us:

✅ Everything is in one place – No more mental math or random notes on our phones. We see all our income and expenses clearly laid out.

✅ It keeps us accountable – We can track who’s spending what and why (because let’s be honest, those impulse purchases add up).

✅ We never miss a payment – With clear tracking, we avoid those sneaky missed deductions.

✅ Budgeting is actually doable – Whether it’s for groceries, travel, or fun nights out, we can set realistic spending limits.

At first, it took a little time to build the habit of updating our budget regularly, but now? It’s second nature. And honestly, having a shared understanding of our finances has strengthened our communication as a couple!

Why Financial Wellness Matters

Financial wellness isn’t just about numbers on a spreadsheet—it’s about peace of mind and building a secure future for yourself and your family. Unexpected expenses will happen. Life will throw curveballs. But when you have a clear financial plan, you’re prepared.

From moving from Japan to Canada, navigating the uncertainties of the pandemic, and adapting to rising inflation, we’ve learned firsthand how valuable a strong financial foundation is. And the best part? You don’t have to be a penny-pincher to achieve it. You just need clarity, consistency, and a plan.

Your long-term financial goals could be:

– buy a new car

– pay off your mortgage

– go on vacation

– attend that music festival you’ve been eyeing

– start your business

– be debt-free

– save for college funds

– plan for retirement

Financial health is defined as the dynamic relationship of one’s financial and economic resources as they are applied to or impact the state of physical, mental, and social well-being.

I loved this article that I found on Forbes. It is a simple yet in-depth way of understanding Financial Wellness.

What Are Your Financial Goals?

When you take charge of your money, you open the door to so many possibilities. What are your biggest financial dreams? Maybe you want to:

💰 Pay off debt and finally break free from high-interest loans.

🚗 Buy a new car without stressing about monthly payments.

🏡 Save for a down payment on your dream home.

🌍 Take that bucket-list vacation (hello, tropical beaches or European adventure!).

🎶 Go to that music festival you’ve been eyeing.

📚 Start a college fund for your kids.

🛠 Launch your own business and finally work for yourself.

👵 Plan for a comfortable retirement so you can enjoy life stress-free.

No matter what’s on your list, financial wellness gives you the freedom to make those dreams a reality.

Teaching Kids About Money

If you have kids, including them in financial discussions can be an amazing learning opportunity. Money habits start early, and giving them a head start on financial literacy is a gift that will last a lifetime.

Here’s how you can make it fun and interactive:

👶 The “Why” – Teach them why work and earning money matter.

🛍 The “What” – Help them understand what the family is saving for.

🗓 The “When” – Planning a family vacation? Show them how saving up makes it possible.

🎯 The “How” – Encourage them to set personal savings goals for something they want.

Whether it’s earning allowance through chores, setting up a piggy bank, or using a digital savings app, helping kids understand money in a real-world context builds lifelong skills.

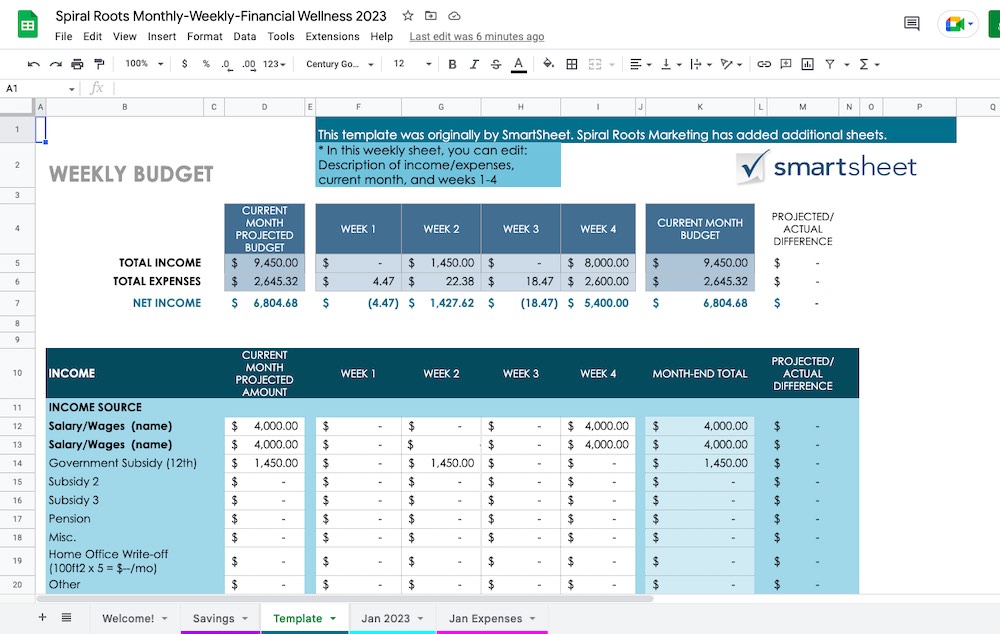

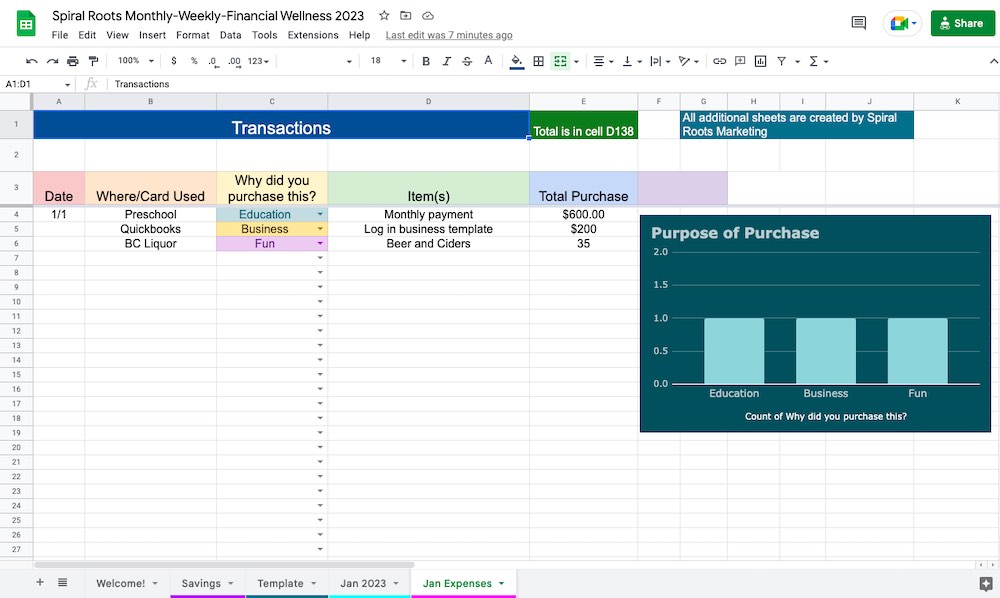

Here’s a glimpse into the template!

Monthly-Weekly Financial Wellness Template (2023)

Now, let’s get to the good stuff—your free budgeting template!

This is a family-friendly version of the original Smart Sheets budgeting template. It’s designed to make managing household finances as seamless as possible.

Enter your fixed expenses (salary, rent, mortgage, childcare, subscriptions, etc.) in the “Template” sheet so you don’t have to re-enter them every month.

In the image below, you’ll fill in monthly/weekly expenses. As you scroll down in the template, you’ll also find sections for “Daily Living”, “Subscriptions”, “Health”, and “Holiday/Vacation”. It’s an overview of your total expenses.

Every week and month, set a date by yourself or together to fill in the blanks. Pretty much all of the spaces are customizable, except the “Projected/Actual Difference”.

Track Your Transactions

Every week, have your online banking accessible or physical receipts handy to fill in your expenses. My husband and I type our expenses into the Google Sheet every Sunday.

Where/Card Used: Type in the establishment and what card you used. For example: Preschool (PCm) — which stands for PC MasterCard.

Why did you purchase this?: You have a simple drop-down to have your purchases categorized. The bar graph on the far right is seamlessly synced together for a visual representation of where your expenses are going.

Get Your Free Google Sheets Budgeting Template

Click on THIS LINK for your FREE budgeting template!

This template comes with simple step-by-step instructions on the first tab. Make sure to make a copy so you can personalize it for your needs!

Final Thoughts

Taking control of your finances isn’t about restriction—it’s about freedom. It’s about knowing where your money is going, setting goals that matter to you, and creating a financial future you feel good about.

The best part? You don’t have to do it alone. When you and your partner (or family) work together, financial planning becomes less of a chore and more of a team effort.

💬 What’s your #1 financial goal right now? Drop a comment below—I’d love to hear from you!

If you found this post helpful, you might also love my Goal Setting PDF Planner—it’s the perfect companion to your financial wellness journey!

Additional resources on financial health and literacy:

- Clever Girl Finance: Articles

- KOHO: Financial Literacy article ( Use CODE: 3EUK8S91 to get the KOHO card today!)

- The Every Mom: Family Budget Tips From a Financial Advisor

- Smart Stuff Blog: Tips to Set Your Kid up for Financial Success

- MoneySense: 6 strategies for teaching kids about money

- NPR: Want to teach your kids about money? Start by including them in the conversation